8 Dec 2025

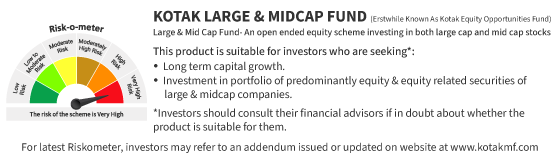

The Kotak Large & Mid Cap Fund follows a structured investment philosophy that blends the market leadership of large cap companies with the possible growth potential of mid cap firms. By maintaining diversified exposure across sectors and adhering to SEBI’s allocation norms the Scheme aims to achieve risk adjusted long term capital appreciation. Its research driven and bottom up stock selection framework ensures disciplined participation in equity markets while managing volatility

Key Takeaways:

- Blend of relative stability and potential growth - Combines large cap resilience with mid cap potential

- Diversified exposure - Invests across multiple sectors and market segments

- Flexibility within SEBI limits - Ensures disciplined yet adaptive allocation

- Suitable for long term investors - Best suited for those with a long term investment horizon

- SIP friendly approach - Supports disciplined wealth creation while managing market timing risk

- Professionally managed - Backed by experienced fund managers and robust research processes

Why Consider Investing in Kotak Large & Mid Cap Fund?

Growth Potential Through Dual Exposure

- The Scheme aims to generate long term capital appreciation by investing in a blend of large cap and mid cap companies.

- Large cap stocks typically bring relative stability and steady performance while mid cap companies offer possible growth potential as they expand their market share.

- By combining both the Scheme allows investors to participate in India’s growth story through a single diversified portfolio striking a balance between consistency and opportunity

If you’d like to understand how large cap and mid cap companies are classified, you can explore Large and Mid Cap meaning.

Diversification Across Sectors and Market Segments

- The Scheme invests across various sectors that are expected to benefit from India’s structural and economic trends

- This diversification reduces concentration risk and helps investors participate in multiple growth drivers such as manufacturing, financial services, technology and consumption

- Sectoral allocation is guided by the fund manager’s research on the growth pattern of the economy ensuring the portfolio evolves with market opportunities

Flexibility Within SEBI Mandated Framework

- Being a Large & Mid Cap Fund (as defined by SEBI) the Scheme maintains at least 35% in large cap stocks and 35% in mid cap stocks at all times.

- This structure offers the fund manager flexibility to adjust allocation dynamically based on market conditions while staying within SEBI’s investment boundaries

Long Term Wealth Creation Potential

- The Scheme’s design encourages investors to adopt a long term approach to equity investing. By staying invested through market cycles investors can benefit from

- The compounding effect of earnings growth in quality businesses and the potential re-rating of mid cap companies as they evolve into larger more established players. This makes the Scheme suitable for investors seeking capital growth over a medium to long term horizon rather than short term trading gains, subject to market risks; past performance may or may not be sustained.

Professional Management and Research Driven Approach

- Managed by an experienced investment team the Scheme follows a bottom up stock selection process backed by in depth research.

- The fund management team actively identifies companies with sustainable earnings visibility, sound governance and competitive advantages factors that are crucial for long term performance

- This disciplined research driven approach ensures that every investment aligns with the Scheme’s overall objective and risk framework

To know more about the fund’s guiding principles and process, you can read the Investment Philosophy of Large and Mid Cap Fund.

Who Should Consider This Scheme?

The Kotak Large & Mid Cap Fund may be suitable for investors who

- Have a medium to long term investment horizon (preferably three years or more) to navigate equity market cycles and benefit from the combination of large and mid cap exposures

- Possess a high risk appetite understanding that mid cap exposure can increase short term volatility.

- Seek a equity allocation that blends the stability of large cap companies with the growth potential of mid cap companies

- Prefer a disciplined and long term investment approach which allows gradual participation in equity markets and helps mitigate the impact of market volatility compared to lump sum investing

- Are aware that the Scheme does not guarantee returns and performance is subject to market risk. Past performance may or may not be sustained in the future

The Scheme may not be suitable for investors who:

- Have a short term investment horizon and are unable to absorb equity market fluctuations.

- Are highly risk averse and prefer capital protection or fixed income instruments

- Expect guaranteed or assured returns as the Scheme invests in equities and equity related instruments that are subject to market risk

Integration into a Portfolio

- The Scheme can act as a core growth component within an investor’s equity portfolio by offering diversified exposure across both large and mid cap segments

- It can complement existing holdings such as a pure large cap fund by adding mid cap exposure for long term growth potential

- Investors may consider using SIP or STP facilities available under the Scheme for disciplined investing and rupee cost averaging

- Due to inherent market volatility investors are advised to review performance and risk alignment periodically

Key Risks and Considerations

- Equity Market Risk: The Scheme is subject to market fluctuations that may impact portfolio value and returns

- Mid Cap and Liquidity Risk: Investments in mid cap companies may face higher volatility and relatively lower liquidity

- Exit Load: As disclosed in the SID redemptions or switch outs within one year may attract an applicable exit load

- Regulatory and Macroeconomic Risks: Changes in taxation, government policy or regulatory guidelines can affect market performance

- Asset Allocation Deviation: Any deviation from the prescribed asset allocation will be rebalanced within timelines permitted under SEBI regulations (currently within 30 business days extendable up to 60 days under specific conditions)

Conclusion

The Kotak Large & Mid Cap Fund is designed for investors seeking possible long term wealth creation through a balanced participation in both stability driven large caps and high growth mid caps. Its diversified portfolio, research led management and adherence to SEBI guidelines make it a suitable choice for those aiming to participate in long term equity growth story while managing risk through disciplined investing

Frequently Asked Questions (FAQs)

1. What type of fund is the Kotak Large & Mid Cap Fund?

It is an open ended equity scheme investing in both large cap and mid cap stocks as defined by SEBI. The Scheme must maintain a minimum of 35% each in large cap and mid cap companies at all times.

2. What is the investment objective of the Scheme?

The Scheme aims to generate long term capital appreciation by investing in a diversified portfolio of equity and equity related securities across large and mid cap segments.

3. What kind of investors should consider this fund?

Investors with a medium to long term investment horizon, high risk appetite and a goal of possible long term wealth creation may consider this fund.

4. How does investing through SIP help in this Scheme?

SIP allows investors to invest small amounts regularly helping them average out purchase costs over time and reduce the impact of short term market volatility.

5. Is there any exit load?

Yes. As per the Scheme Information Document (SID) redemptions or switch outs within one year attract an applicable exit load. Investors shall refer to SID for applicable exit load details or visit our website for the same.

6. What is the suitable investment horizon for this Scheme?

Investors should have a minimum horizon of 3 + years to allow the fund to navigate market cycles and realize long term growth potential.

Kotak Large and Midcap Fund

An open ended equity scheme investing in both large and mid cap stocks

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What type of fund is the Kotak Large & Mid Cap Fund?", "acceptedAnswer": { "@type": "Answer", "text": "It is an open ended equity scheme investing in both large cap and mid cap stocks as defined by SEBI. The Scheme must maintain a minimum of 35% each in large cap and mid cap companies at all times." } }, { "@type": "Question", "name": "What is the investment objective of the Scheme?", "acceptedAnswer": { "@type": "Answer", "text": "The Scheme aims to generate long term capital appreciation by investing in a diversified portfolio of equity and equity related securities across large and mid cap segments." } }, { "@type": "Question", "name": "What kind of investors should consider this fund?", "acceptedAnswer": { "@type": "Answer", "text": "Investors with a medium to long term investment horizon, high risk appetite and a goal of possible long term wealth creation may consider this fund." } }, { "@type": "Question", "name": "How does investing through SIP help in this Scheme?", "acceptedAnswer": { "@type": "Answer", "text": "SIP allows investors to invest small amounts regularly, helping them average out purchase costs over time and reduce the impact of short term market volatility." } }, { "@type": "Question", "name": "Is there any exit load?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. As per the Scheme Information Document (SID), redemptions or switch outs within one year attract an applicable exit load. Investors should refer to the SID or visit the website for detailed exit load information." } }, { "@type": "Question", "name": "What is the suitable investment horizon for this Scheme?", "acceptedAnswer": { "@type": "Answer", "text": "Investors should have a minimum horizon of 3+ years to allow the fund to navigate market cycles and realize long term growth potential." } } ] }