18 Nov 2025

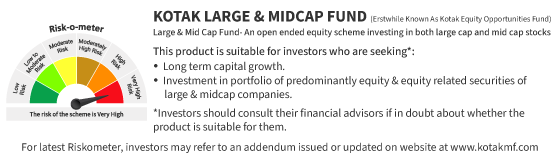

The Kotak Large & Mid Cap Fund is designed to achieve long term wealth creation by investing predominantly in a blend of large cap and mid cap companies. As defined under SEBI’s mutual fund categorization framework, Large and Mid Cap Funds invest in both large cap firms (ranked 1st to 100th by market capitalization) and mid cap companies (ranked 101st to 250th). By combining the market leadership and resilience of large caps with the growth potential of mid caps the fund seeks to offer a diversified approach to long term equity investing. Maintaining diversified exposure across sectors and market segments the scheme seeks to achieve long term capital appreciation while adhering to SEBI’s investment and rebalancing guidelines

Key Takeaways

- Equity exposure - Combines large cap relative stability with mid cap potential growth

- SEBI defined categories - Large caps (1–100) and mid caps (101–250) by market capitalization

- Investors can explore Large and Midcap Fund Meaning to better understand the SEBI classification, structure and role of this category within equity mutual funds

- Diversified strategy - Invests across sectors based on company fundamentals and growth potential

- Risk management tools - Use of derivatives, hedging and defensive allocation flexibility

- Regulatory discipline - Follows SEBI’s asset allocation and rebalancing norms

- Suitable for long term investors - Suitable for those seeking capital growth with moderate risk appetite

Investment Strategy

The Kotak Large & Mid Cap Fund follows a diversified investment approach focusing on both large cap and mid cap companies. The aim is to achieve long term capital growth by investing in businesses that demonstrate strong fundamentals and future potential.

1. Sector and Stock Selection

The fund invests across different sectors of the economy. The selection of sectors and companies depends on their performance, growth prospects and valuations.

2. Asset Allocation Approach

The allocation between large cap and mid cap stocks and across other asset classes is guided by the overall macro economic environment including factors like growth outlook, inflation and market valuations.

While large cap stocks provide stability, mid cap stocks are chosen for their potential to deliver possible higher growth over time

3. Bottom Up Stock Picking

The portfolio construction follows a bottom-up investment style where each company is evaluated on its individual merits such as management quality, business model, financial strength and competitive advantage rather than just sector or market trends

4. Flexibility of Investments

- The scheme can invest in both listed and unlisted equity shares in line with SEBI (Mutual Fund) Regulations, 1996 and amendments thereof

- It may also invest in listed or unlisted rated or unrated debt and money market instruments provided such investments remain within the prescribed limits

- Any investment in unrated debt securities will require prior approval from the AMC’s Board and will adhere to defined parameters

- If an investment proposal falls outside these parameters approval from both the AMC and Trustee Boards will be taken before execution

5. Participation in IPOs

The scheme may invest in companies coming out with the IPO and whose post issue market cap (based on the issue price) would fall under above mentioned criteria

6. Inter Scheme Investments

The scheme may invest in other mutual fund schemes either from Kotak Mahindra Mutual Fund or other AMCs without charging any additional management fee.

However the total inter scheme investments made by all schemes under the Kotak Mahindra Asset Management Company or any other AMC cannot exceed 5% of the net asset value (NAV) of Kotak Mahindra Mutual Fund

7. Use of Derivatives

The scheme may use exchange traded derivatives for purposes such as hedging, portfolio rebalancing or other permitted strategies in accordance with SEBI guidelines. These instruments help manage risk and align the portfolio with its investment objective

8. Portfolio Turnover

Being an open ended equity scheme the fund experiences regular inflows and outflows through investor purchases and redemptions. While this may result in portfolio turnover the fund manager aims to optimise trading activity ensuring that it enhances returns without incurring unnecessary transaction costs like brokerage and taxes.

The scheme does not target a specific turnover ratio but focuses on efficient execution, cost control and long term value creation

Portfolio Allocation Approach

| Asset Class | Instruments | Indicative allocations (% of total assets) | ||

|

||||

| A | Equity and Equity Related Securities |

|

||

| A1 | investments in equity and equity related securities of large cap companies$ |

|

||

| A2 | investments in equity and equity related securities of mid cap companies$ |

|

||

| A3 | investments in equity and equity related securities of Companies other than large and mid-cap companies |

|

||

| B | Debt and Money Market Securities* |

|

||

| C | Units issued by REITs & InvITs |

|

- Large Cap Companies are ranked 1st to 100th by full market capitalization

- Mid Cap Companies are ranked 101st to 250th by full market capitalization

The list is published by AMFI and updated every six months.

As per para 2.7 of SEBI Master Circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024, Large Cap: 1st -100th company in terms of full market capitalization. Mid Cap: 101st -250th company in terms of full market capitalization. Small cap: 251st company onwards in terms of full market capitalization

Additional Investment Guidelines

To enhance diversification and risk management the scheme may also

- Overseas Investments - 20%of the net assets of the Scheme

- Invest up to 10% in REITs and InvITs to capture opportunities in real estate and infrastructure investment vehicles

- Invest up to 50% of its debt and money market exposure in securitised debt instruments

- Securities Lending – Aggregate 50% of net assets of the Scheme, Single intermediary 50% of the net assets of the Scheme

- Repo transactions in corporate debt securities - 10% of the net assets of the scheme

- The scheme may also use derivatives and hedging strategies to reduce portfolio risk as permitted by SEBI guidelines

Portfolio Rebalancing

In the event of any deviation from mandated asset allocation mentioned above, due to passive breaches, rebalancing period will be Thirty (30) business days

In case the portfolio is not rebalanced within Thirty (30) business days, justification in writing, including details of efforts taken to rebalance the portfolio shall be placed before the Investment Committee.

Short Term Defensive Considerations

In volatile market conditions or during periods of uncertainty, the fund may temporarily alter its asset mix as a defensive measure. This helps protect investor capital without deviating from the scheme’s long-term investment objective. These proportions may vary depending upon the perception of the Fund Manager, the intention being at all times to seek to protect the interests of the Unit holders. In case of any deviation, the portfolio shall be rebalanced within 30 calendar days.

Conclusion

The Kotak Large and Mid Cap Fund seeks to provide investors with an opportunity for long term capital appreciation by investing in large and mid-cap companies. Its investment strategy blends the stability of established large caps with the growth potential of emerging mid caps supported by disciplined stock selection and sector diversification. The fund’s bottom up approach, macro driven asset allocation and prudent use of derivatives and defensive strategies enable it to manage risks effectively while pursuing consistent capital appreciation. It is suitable for investors seeking a well diversified equity fund with a medium to long term investment horizon. To evaluate if this scheme aligns with your goals and risk profile you can explore Investor Suitability for Large and Mid Cap Funds which provides guidance on who should consider investing in this category.

FAQs

1. What type of fund is the Kotak Large & Mid Cap Fund?

It is an equity mutual fund investing in both large and mid cap companies to provide a balance between stability and growth potential

2. What is the investment objective of the scheme?

The fund aims to achieve long term capital appreciation by investing predominantly in equity and equity related securities of large and mid cap companies

3. How are large and mid cap companies defined as per SEBI?

Large cap companies are ranked 1st to 100th, and mid cap companies are ranked 101st to 250th in terms of full market capitalization as per the AMFI list updated semi annually

4. Can the fund invest in other asset classes?

Yes, it can invest in debt, money market instruments, REITs, InvITs and overseas securities within SEBI prescribed limits.

5. Who should consider investing in this fund?

Investors with a long term horizon looking for growth through a diversified portfolio of large and mid cap stocks and who can withstand short term market volatility

Kotak Large and Midcap Fund

An open ended equity scheme investing in both large and mid cap stocks

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.