Portfolio

As on Jan 31, 2026

Performance

As on Jan 31, 2026

let's calculate your dividend

since inception, you would have earned ₹ - as Dividend and your current value of investment ₹ 1,09,312

Past performance may or may not be sustained in future. Pursuant to payment of dividend, the NAV of the scheme will fall to the extent of payout and statutory levy (if applicable).

The dividend rates could be inclusive of statutory levy, if any. The dividend received by investors will be net of statutory levy (as applicable).

Dividends declared from benchmark's constituents isn't taken into account when comparing with investment in scheme's dividend plans.

| NAV Date | NAV | Units | Cash Flow | Scheme Value |

|---|

- Income over Target Maturity Period

- An open-ended Target Maturity Index Fund tracking Nifty AAA Bond Jun 2025 HTM Index subject to tracking errors

Details

Source: *ICRA MFI Explorer ## Risk rate assumed to be % (FBIL Overnight MIBOR rate as on NA) **Total Expense Ratio includes applicable B30 fee and GST.

Source: *ICRA MFI Explorer

## Risk rate assumed to be %

(FBIL Overnight MIBOR rate as on NA)

**Total Expense Ratio includes applicable B30 fee and GST.

- Income over Target Maturity Period

- An open-ended Target Maturity Index Fund tracking Nifty AAA Bond Jun 2025 HTM Index subject to tracking errors

About the Kotak Nifty AAA Bond Jun 2025 HTM Index Fund

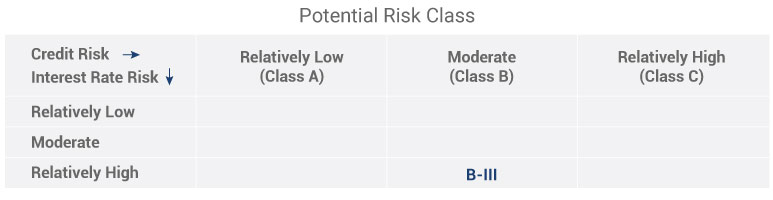

- Kotak Nifty AAA Bond Jun 2025 HTM Index Fund - An open-ended Target Maturity Index Fund investing in constituents of Nifty AAA Bond Jun 2025 HTM index subject to tracking errors. A moderate interest rate risk and relatively low credit risk.

- Kotak Nifty AAA Bond Jun 2025 HTM Index Fund.