18 Feb 2026

Imagine you walk into a restaurant, craving a giant pizza. It’s too big (and too expensive) for one person to finish. But what if the restaurant allowed you and several others to buy just a slice each—giving everyone access to something they couldn’t afford alone?

Asset tokenisation works like that.

Instead of requiring one big buyer to own a premium asset—like real estate, infrastructure, or art—you can divide ownership into many small “digital slices”, called tokens. Each token represents a share of the asset, recorded securely on a blockchain.

This small twist is quietly reshaping global finance.

What Exactly Is Asset Tokenisation?

For decades, investing in high-quality assets followed a familiar script. Prime real estate demanded large capital outlays, infrastructure assets were accessible only to institutions, and alternative investments like art or private credit remained firmly behind closed doors. Value existed—but access was limited, liquidity was scarce, and ownership was rigid.

Asset tokenisation is quietly rewriting this script.

It is the process of converting rights to a real‑world asset into digital tokens on a blockchain. These tokens behave as digital certificates of ownership—transparent, tamper‑proof, and easier to transfer.

✔ The asset itself does not change

✔ How ownership is structured changes completely

For instance, a commercial building worth ₹100 crore can be divided into 1 lakh tokens. Each token holder owns a fraction—earning rental income, price appreciation, and verified ownership through blockchain‑based smart contracts.

Tokenisation is not a cryptocurrency speculation—it is an infrastructure upgrade to how assets are managed, traded, and owned.

India stands at a unique inflection point:

- strong digital adoption

- forward‑thinking regulators

- massive investor appetite

- a thriving fintech sector

This combination positions India to lead the next wave of democratised asset ownership, making premium investment opportunities accessible to everyone—not just a privileged few.

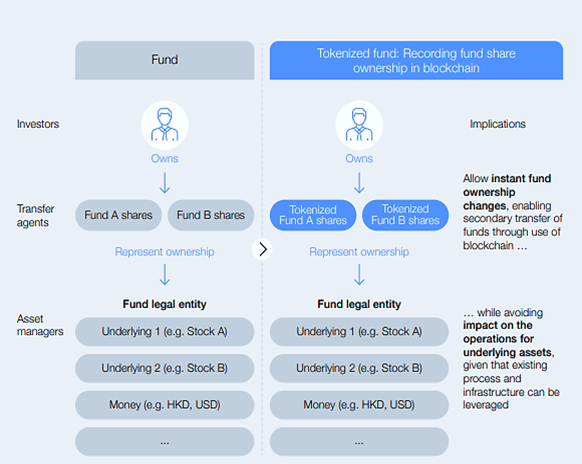

Traditional Funds v/s Tokenized Funds

Source: World Economic Forum (WEF)

Why Is Tokenisation Suddenly Everywhere?

As explained in detail below, several forces are converging:

1. Search for liquidity

Large assets—real estate, infrastructure, private credit—are locked and illiquid. Tokenisation unlocks “slices” that can be easily traded.

2. Technology maturity

Blockchain systems are now scalable, secure, and regulator‑friendly.

3. Changing investor expectations

Digital access, fractional ownership, 24×7 trading—these are becoming standard demands.

4. High asset concentration

Tokenisation democratizes access—previously, only large investors could buy premium assets.

Together, they make tokenisation the next major shift in financial markets.

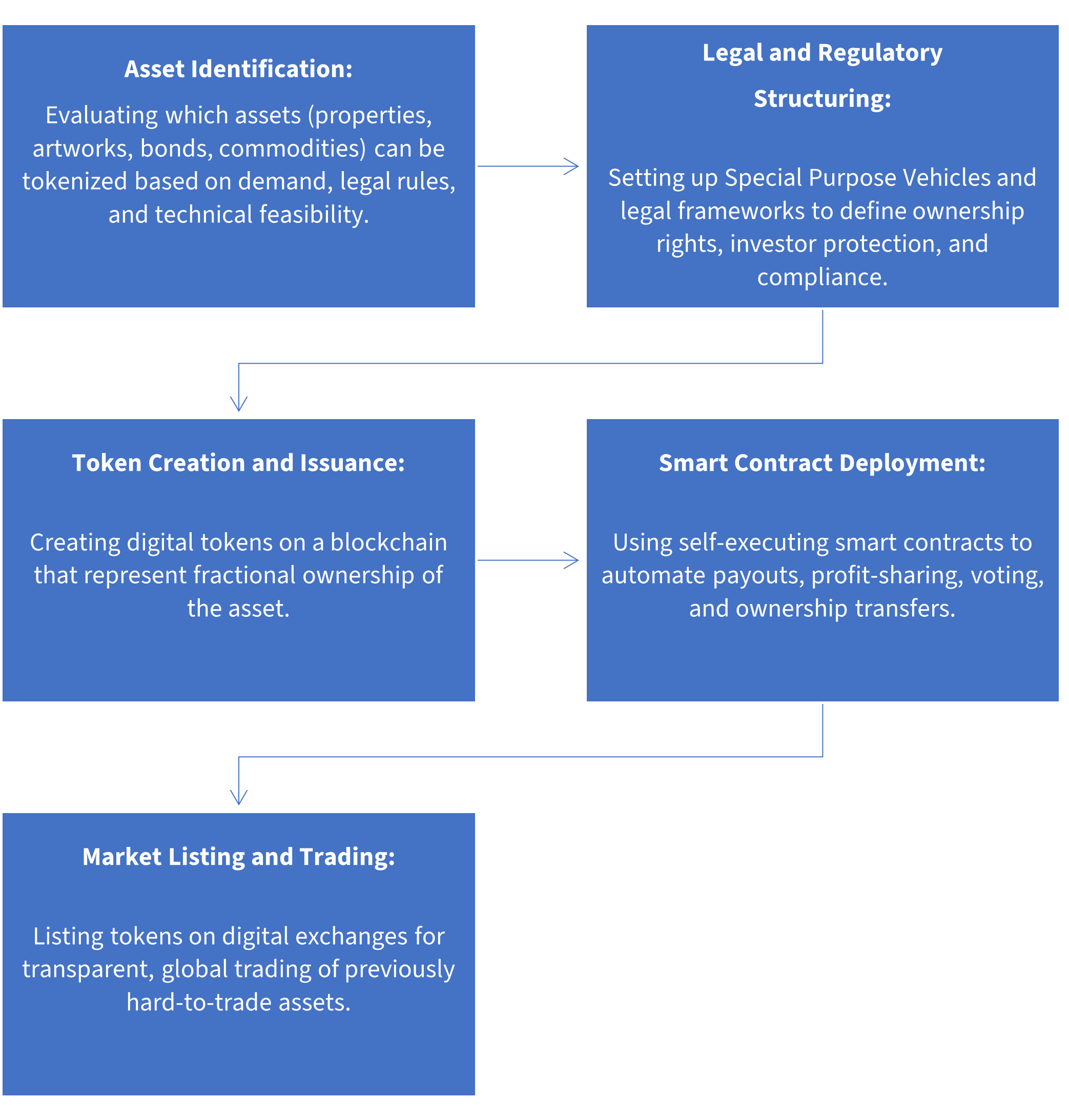

How Asset Tokenisation Works? (Simple Breakdown)

Tokenisation follows a structured, regulated workflow:

Why Tokenisation Is a Game‑Changer:

Tokenisation is rewriting the rules of ownership and investment, unlocking speed, access, and efficiency in ways traditional markets simply couldn’t.

1. Enhanced Liquidity

Tokenisation may turn traditionally illiquid assets—like real estate, art, or private credit—into digitally tradeable units. This means investors can enter or exit positions almost instantly, unlocking value that was earlier “stuck” for years.

2. Global Accessibility

Blockchain breaks geography. Anyone anywhere can buy a fraction of an asset—whether it's a US office building or an Indian warehouse—broadening investor participation and opening global investment doors for everyone.

3. Transparency & Security

Every token movement is recorded on an immutable blockchain ledger. This tamper‑proof audit trail builds trust, may reduce fraud, and ensures complete visibility for regulators, issuers, and investors.

4. Cost Efficiency

Tokenisation cuts out multiple intermediaries—registrars, custodians, middlemen—slashing costs. Faster settlements, sometimes even instant (T+0), mean smoother transactions and reduced operational expenses.

5. Operational Efficiency

Smart contracts automate critical functions such as payouts, compliance checks, profit‑sharing, and ownership transfers. This reduces human error, speeds up processes, and makes asset management far more efficient.

6. Institutions Are Onboard Too

Goldman Sachs issued a €100 million tokenized bond that settled same day, instead of the usual five. This shows how tokenization enhances institutional efficiency as well.

Source: World Economic Forum (WEF)

Real-World Applications Demonstrating Market Viability

Asset tokenization has moved beyond theoretical concepts to practical implementations across diverse industries. These real-world applications showcase the technology's versatility and potential to transform traditional asset management approaches.

Global Cases of Asset Tokenisation

1. BlackRock's BUIDL (BlackRock USD Institutional Digital Liquidity Fund), Fund launch in 2024 represents institutional adoption of tokenization principles. This tokenized money market fund on the Ethereum blockchain combines traditional financial instruments with decentralized finance elements, offering investors stable tokens with real-time interest accrual.

Source: Businesswire

2. HSBC Gold Token (Retail‑Friendly Tokenized Gold)

HSBC recently introduced a Gold Token available to retail investors. Each token represents a fraction of gold held in HSBC vaults, allowing small-scale investors to access a traditionally high-barrier market. The key innovation is blockchain-based settlement, which lowers transaction costs and speeds up ownership transfers. Commodities like gold have global demand. Tokenization lowers entry requirements and expands market participation.

Source: hsbc

3. Sygnum Bank's Picasso artwork tokenization in 2021 showcased art market applications when the bank tokenized Picasso's "Fillette au beret," enabling 50 investors to acquire fractional shares through 4,000 tokens. This project significantly democratized access to high-value art investments while enhancing asset liquidity through blockchain-enabled trading mechanisms.

Source: Sygnum Bank

4. Dubai is redefining global property investment through real estate tokenisation. Investors from around the world can access Dubai’s luxury residences, commercial spaces, and income-generating properties with low entry barriers, using only a digital wallet. The rapid sell-out of a tokenised villa by Prypco highlights the strong global demand for fractional ownership of premium real estate assets.

Source: indiatimes

Indian Case of Asset Tokenisation:

India is rapidly embracing blockchain‑driven modernisation. Here’s how tokenisation is being applied locally:

NSE IFSC (GIFT City): Token‑like Digital Securities

India’s first global financial hub—GIFT City—has initiated India’s first regulatory consultation to create a framework for tokenisation of financial and real‑world assets.

While NSE IFSC has not yet launched tokenised or digitally native securities, the proposed framework envisions features such as digital ownership, fractionalisation, smart‑contract‑based compliance, faster settlement, and programmable assets.

This makes GIFT City the centre of India’s regulatory exploration of tokenised financial infrastructure—but not yet a live implementation.

Source: NSE

Challenges that currently hinder the adoption of Tokenization:

- Evolving regulations: The legal framework is still taking shape, creating uncertainty for investors and platforms.

- Limited distribution infrastructure: Networks and mechanisms for issuing and trading tokenized assets are still being built.

- Education gap: Confusion between blockchain, crypto, and tokenization slows understanding and adoption.

- Nascent ecosystem: The supporting financial and technical infrastructure is still in early development.

- High upfront costs: Significant setup and transition costs discourage adoption for many market participants.

Charting the Path Forward

Asset tokenization is reshaping how markets function and how investors access different asset classes. As technology matures, regulations evolve, and adoption grows, it is opening powerful new pathways for financial innovation and inclusion.

To succeed, organizations must focus on strong regulatory compliance secure and scalable infrastructure, and continuous investor education—ensuring real‑world value and practical use cases drive adoption.

With each successful deployment, confidence in tokenized assets increases. As clarity improves and systems advance, tokenization is set to become a standard part of modern portfolios, transforming how we view ownership, value, and participation in the digital age.

Nandan Nilekani, co-founder of Infosys and founding chairman of Aadhaar (UIDAI i.e. Unique Identification Authority of India), suggested tokenization of land assets as one of the ways to increase capital in the country if India is to reach 8% GDP growth from the current 6%. “We believe that tokenization of land assets using a proper ledger, and so on, can unlock these things where you can tokenize every piece of land and then that can be traded very easily,” he said during a public talk at an event organized by Arkam Ventures.

Nilekani’s 8-Point Plan to Reach 8% GDP Growth

Sources: EY, NPCI, pwc, Nandan Nilekani Calls for Tokenization of Land in India

KMAMC is not guaranteeing/offering/communicating any indicative yield/returns on investments. The stocks/sectors mentioned in this slide do not constitute any recommendation and Kotak Mahindra Mutual Fund may or may not have any future position in these sectors/stocks. Companies mentioned don’t constitute recommendation, brand name affiliation disclaimer & companies mentioned for illustrative purpose only.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.