12 Feb 2026

Why is the Cost of Learning Rising Faster Than Income?

Education has long been considered the most powerful investment an Indian family can make. Parents stretch budgets, sacrifice consumption, and postpone personal goals so their children can study in better schools, colleges, and universities. For decades, this social contract worked because education costs broadly grew in line with incomes.

That equation is now breaking down.

Today, the cost of education is rising far faster than general inflation, income growth, and long-term household savings. This phenomenon, Education Inflation, is transforming education from an opportunity multiplier into a significant financial concern for families.

From private school fees and coaching classes to engineering, medical, and overseas degrees, the data tells a clear story: education has become one of the fastest-inflating components of household expenditure in India.

Your child levels up in school only to find the fees have already moved to the next level.

What Is Education Inflation and What Makes It Different?

Education inflation refers to the sustained rise in the cost of schooling, higher education, and professional degrees at a pace that exceeds general consumer inflation.

Unlike regular inflation, education inflation is driven by structural factors such as:

- Faculty and staff salaries

- Administrative, compliance, and technology costs

- Infrastructure upgrades and campus expansion

- Currency depreciation (for overseas education)

- Global competition for quality talent and facilities

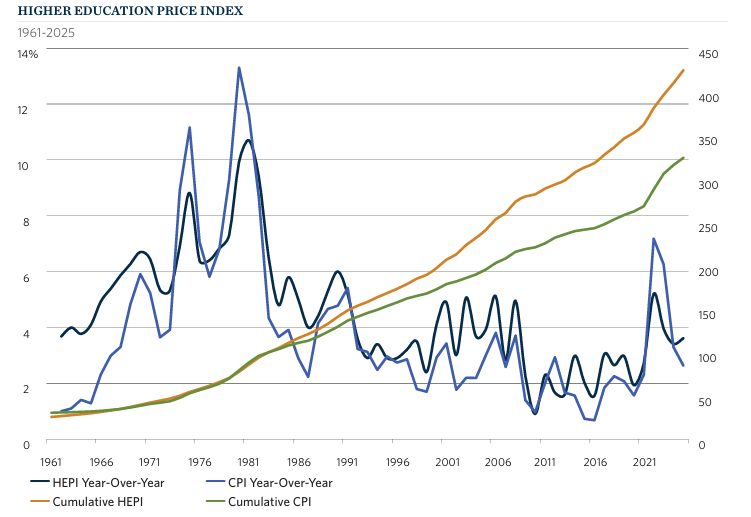

Globally, the Higher Education Price Index (HEPI), a widely tracked measure of education-specific inflation, shows that education costs consistently rise faster than consumer inflation. Even small annual gaps may compound sharply over time, materially eroding affordability.

Source: Commonfund Higher Education Price Index | 2025 Update, Above Image the Higher Education Price Index (HEPI) and the Consumer Price Index (CPI) from 1961 to 2025. Cumulative HEPI is represented by the steadily increasing orange line, indexed to 100 for 1983, and should be read using the right-hand scale. The jagged lines trace percentage year-over-year changes in HEPI and CPI and should be read using the left-hand scale. In this chart and in the supporting data in Table A on page 3, HEPI and CPI are presented in two ways—as an index level and as a year-over-year percent change. HEPI data beginning with FY2002 have been restated to reflect the methodological improvements adopted in 2009.

Globally, policymakers and institutions track education‑specific inflation using indicators like the Higher Education Price Index (HEPI). According to the latest Common fund Higher Education Price Index (FY2025), education costs rose 3.6%, compared with 2.6% consumer inflation, marking the second consecutive year education inflation exceeded general inflation.

This trend is not new. HEPI has exceeded CPI in 9 of the last 11 years globally, illustrating a structural inflation problem unique to education.

Source: Commonfund Higher Education Price Index

The Indian Reality: Aspirations Under Pressure

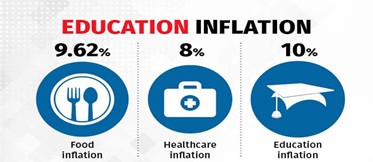

In India, education inflation is far more visible at the household level. Multiple studies and media reports suggest education inflation of 10–12% annually, significantly higher than average CPI inflation of 5–6%.

The pressure is even more acute for higher and overseas education:

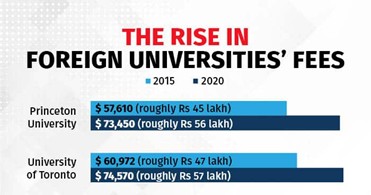

- A foreign undergraduate degree that cost ₹50–60 lakh a few years ago now costs ₹75 lakh to over ₹1 crore

- Education loans have shifted from being supplementary to becoming the primary funding source

- Even families that plan early struggle as costs compound relentlessly

Education, especially global education, has become one of the most inflation-sensitive items in a family’s financial plan.

Source: ET Wealth

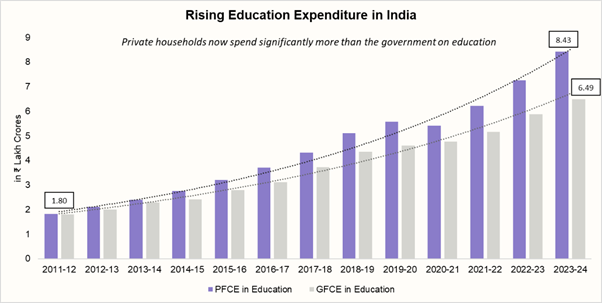

Source: MoSPI(Ministry of Statistics and Programme Implementation), 1 Finance Research

Note: PFCE = Household spending on education (fees, books, coaching, etc.)

GFCE = Government spending on public education (schools, teachers, infrastructure).

According to MoSPI data, household spending on education has risen sharply over the past decade, increasing from ₹1.8 lakh crore in FY12 to ₹8.43 lakh crore in FY24, a 4.6x jump in just 12 years. This surge goes beyond mere fee inflation and points to a clear behavioural shift among families. Education’s share in total private consumption expenditure has grown from 3.1% to 4.1% during this period, despite broader pressures like inflation and job insecurity. On a per-capita basis too, spending has climbed significantly, from around ₹1,500 in FY12 to nearly ₹6,100 in FY26. Together, these trends highlight how education is no longer seen as a discretionary cost but as a non-negotiable investment, with families prioritizing it regardless of economic uncertainties.

Why Education Inflation Hurts More Than Normal Inflation?

CPI inflation captures essentials such as food, medical, fuel, housing, and transport. Education behaves very differently.

Education-related expenses include:

- School and college fees

- Books, uniforms, and transport

- Coaching and competitive exam preparation

- Higher education and overseas study

At 10–12% annual inflation, education costs nearly double every 6–7 years. A course costing ₹10 lakh today can easily cost ₹40–50 lakh by the time a child reaches college age—excluding accommodation, coaching, or overseas exposure.

Source: MOSPI, (Ministry of Statistics and Programme Implementation) EduFund Research

Key Facts on Rising Education Costs

1. Education Inflation vs General Inflation

- Education inflation in India: ~10–12% annually

- CPI inflation: ~5–6%

- Globally, private and international school fees often rise 5–6% annually due to higher operating costs

2. School Fees and Household Burden

- Around 44% of urban parents report school fee hikes of 50–80% over the last three years

- In major cities, annual per-child costs often exceed ₹2.5–3.5 lakh

- Many middle-class families now spend 40–80% of annual income on education for one child

3. Private vs Public Education Divide

- Urban private school costs can be up to 9× higher than government schools

- Weak regulation and mandatory add-ons (transport, uniforms, development fees) push costs higher

4. Higher Education and Study Abroad

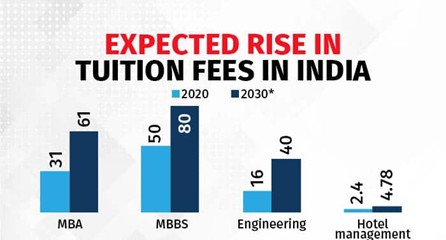

- Professional degrees in private institutions cost 2–3× more than a decade ago

- Overseas education typically costs ₹30 lakh to ₹1 crore+ per student

5. Costs Beyond Tuition

- Coaching, boarding, books, uniforms, transport, and GST on supplies significantly raise total expenses

Source: ET Wealth

*Future projections based on analysis of past inflationary data; subject to change; Figures in lakh Source: Moneycontrol

Overseas Education: Inflation Meets Currency Risk

The pressure intensifies when global education enters the picture:

- Overseas programs now cost ₹75 lakh to ₹1.5 crore

- Rupee depreciation alone can raise total costs by 15–25%

- Living costs, healthcare, and visa compliance amplify the burden

Even moderate tuition inflation becomes severe when combined with currency volatility.

Source: ET Wealth

Average cost of a 4-year graduate course Source: University websites, moneycontrol

Household Behavior Is Already Changing

According to national data, household spending on education has surged:

- Total household education spending rose from ₹1.8 lakh crore in FY12 to ₹8.43 lakh crore in FY24—a 4.6× increase

- Education’s share of private consumption increased from 3.1% to 4.1%

- Per-capita spending climbed from ~₹1,500 to nearly ₹6,100

Education is no longer discretionary. Families prioritize it despite inflation, job insecurity, and economic uncertainty.

Source: ET Wealth

The Education Loan Dilemma:

While rising education costs have certainly led even affluent families to rely more on loans, this shift shouldn't be seen as a burden.

- In many cases, it’s a strategic financial choice. Larger loan sizes and longer tenures can actually help families preserve their long-term investments, such as SIPs and mutual funds, which continue compounding instead of being prematurely liquidated.

- Structured repayment periods and flexible moratoriums ensure that repayments align with a student’s earning curve, not with a family’s immediate cash flows. Instead of delaying wealth creation, an education loan, when used smartly, can prevent the far greater opportunity cost of depleting long-term savings or emergency reserves.

- Rather than shifting inflation risk into the future, education loans can distribute it more evenly over time while giving students access to quality education exactly when they need it.

In this way, education loans can complement long-term investments such as SIPs and MFs, providing financial continuity and protecting the very investment discipline that helps families stay ahead of education inflation.

Why This Is a Macro Issue, Not Just a Family Problem

Unchecked education inflation leads to:

- Growing inequality in access to quality education

- Higher debt-to-income ratios among young professionals

- Delayed wealth creation and retirement planning

- Education shifting from an equalizer to a privilege multiplier

When learning becomes unaffordable, the long-term social cost far exceeds any short-term fee hike.

The Biggest Planning Mistake Families Make

Most families plan education costs using CPI assumptions.

Reality Check:

| Expense Head | Rising Cost |

|---|---|

| Household expenses | ~5–6% |

| Medical costs | ~7–8% |

| Education (India) | ~10–12% |

| Overseas education (with currency risk) | ~12% |

Source: Moneycontrol

Using CPI almost guarantees under-saving.

How Families Can Respond

Education inflation cannot be controlled but its impact can be managed:

- Start early: Time is the strongest defense against compounding

- Use growth assets thoughtfully: Education goals must outpace education inflation

- Use education loans strategically: Families can use education loans to supplement investments, preserve long-term compounding, and manage large tuition payments without disrupting financial stability

- Plan overseas education separately: Model tuition, currency, and living costs realistically

Why Potential Growth Assets Can Be a Powerful Tool Against Education Inflation

Education costs rise every year, often faster than traditional savings options. Simply saving isn’t enough; your money needs to grow faster than inflation.

A Systematic Investment Plan (SIP) helps by investing regularly in potential growth assets such as equities, gold, and real estate. Through diversification and disciplined investing, your wealth benefits from the power of compounding and long-term growth potential.

Starting early and staying consistent allows investments to keep pace with and often outgrows education costs. Early planning also helps reduce future financial stress.

Raise a Scholar, With Smarter Financial Planning

Every parent wants to give their child wings, not worries. But as education costs race ahead, delayed planning can turn hope into pressure and dreams into difficult choices.

Education deserves foresight and prudent financial planning. Starting early with disciplined investing is not just a financial decision, it is an act of care.

Education remains one of the strongest drivers of upward mobility. What has changed is its economics.

India is entering an era where education costs are rising faster than incomes and faster than most families expect. The real risk today is not the price of education, but underestimating how quickly that price is increasing.

Families that recognize education inflation early and plan for it consciously, blending disciplined investing with smart borrowing when needed. This can ensure education remains a gateway to opportunity, not a lifelong financial burden.

Mrs Shibani Kurian, Senior Executive Vice President, Kotak Mahindra AMC adds: On one hand, our child’s education is a goal most of us have. On the other hand, Inflation in education is also reality. We have seen that education costs rise faster than average CPI inflation. The most effective tool to battle this is compounding. Early investing turns compounding into the most effective hedge against education cost inflation. Hence, investing early for your child’s education allows small, regular savings to grow steadily, reducing the pressure of large, last‑minute expenses when costs peak. The good news is—you don’t need big amounts if you start early and therefore starting a SIP is probably the smartest investment planning tool for all of us.

Disclaimers

KMAMC is not guaranteeing/offering/communicating any indicative yield/returns on investments. The stocks/sectors mentioned in this slide do not constitute any recommendation and Kotak Mahindra Mutual Fund may or may not have any future position in these sectors/stocks. These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Please note: Blog thumbnail has been generated by AI.