24 Dec 2025

When we think of salary hikes for government employees, most imagine the small annual increment, typically around 3%, they receive every July. The 8th Pay Commission stands apart as a major reset. It’s not just a raise; it’s a full-scale reset of the pay structure, covering basic pay, allowances, and pensions. Why is this necessary? Because inflation and living costs don’t wait for modest yearly hikes. Over a decade, prices surge, lifestyles evolve, and the gap between income and expenses widens. It is also essential to ensure that government employees maintain their purchasing power, when compared to their private-sector counterparts. While pay hikes in the private sector often outpace those in government roles, bridging this gap is crucial for fostering fairness, motivation, and long-term financial security for public servants. A well-calibrated approach not only sustains morale but also reinforces the value of government jobs in driving societal progress.

The Pay Commission bridges that gap. By revising pay scales every 10 years, it ensures government employees maintain purchasing power and financial security. And here’s the bigger picture: this isn’t just about salaries, it’s about stimulating demand across the economy. Higher disposable income means more spending on homes, cars, travel, and everyday goods, creating a ripple effect that boosts sectors from FMCG to real estate. In short, the 8th Pay Commission is not just a pay hike, it’s a growth trigger for India’s consumption story.

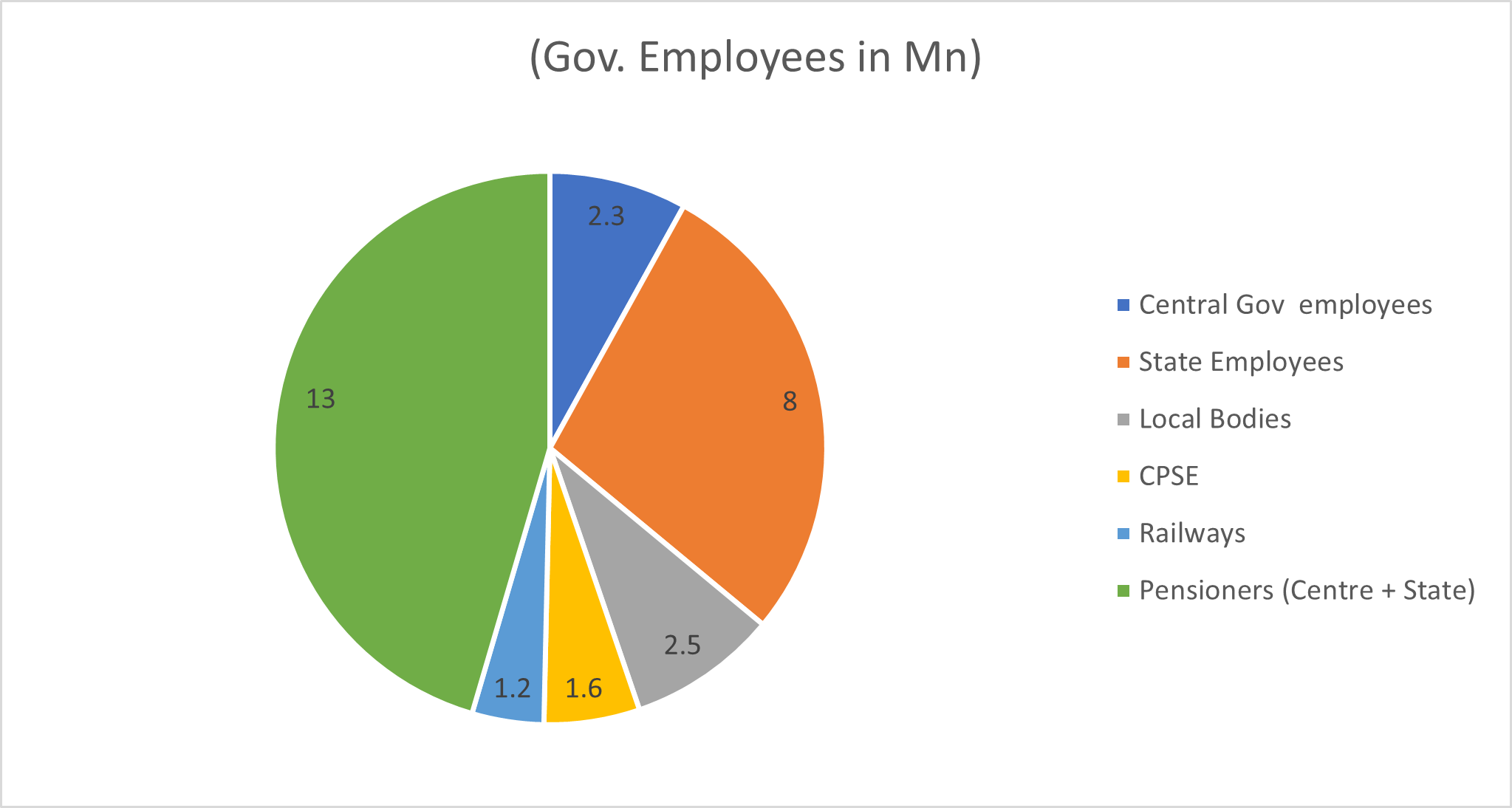

With ~ 30 Mn employees on government payroll, ~ 5% of India’s working population will benefit from this pay hike directly. The next largest employer in India from private sector, Tata Consultancy Services (TCS) in comparison employs only 0.6 Mn people.

Source: The Hindu, UBS, PIB

The 8th Central Pay Commission has appointed its members, and its Terms of Reference were notified on November 3, 2025.

Source: gconnect.in

How much hike expected in 8th Pay Commission?

Fitment factor: The fitment factor is a key number used to revise government salaries and pensions in India whenever a new Pay Commission is introduced. It works like a multiplier: the existing basic pay of a central government employee or pensioner is multiplied by the fitment factor to calculate the revised basic pay under the new pay panel.

For example, if your current basic pay is ₹20,000 and the fitment factor is 2.5, your revised basic pay becomes ₹50,000 (20,000 × 2.5). This simple formula helps align salaries with inflation, cost of living, and evolving economic conditions. Historically, earlier pay commissions used increasing fitment factors: the 6th Pay Commission had a factor around 1.86, and the 7th Pay Commission used 2.57. For the 8th Pay Commission, experts project the fitment factor to be somewhere between 1.8 and 2.86 (exact figures are not yet officially notified). A higher factor means a larger increase in the basic salary.

The fitment factor is very important for employees and pensioners because it directly impacts take-home pay and pensions. A fair fitment factor helps improve purchasing power and makes government pay scales more in line with current economic needs

Source: bajajfinserv.in

What History Tells Us About Pay Commission Impact?

The increase in the central government's wage bill was 25% YoY in FY17. The ripple effect of past pay commissions on India’s fiscal math and consumption is clear.

7th CPC (2016): The central government’s wage bill jumped from 2.6% of GDP in FY16 to 3% in FY17, a rise of 40 basis points.

6th CPC (2008): The increase was even sharper, moving from 2% of GDP in FY08 to 2.8% in FY09 (+80bps) and then to 3.5% in FY10 (+70bps).

Why such a spike? The delay in implementing the 6th CPC meant arrears piled up for over two years, creating a sudden surge in payouts when changes finally rolled out in September 2008.

States mirrored this trend, though adoption dates varied. Salary spending rose from 2.2% of GDP in FY16 to 3.2% in FY17 (+100bps) and further to 3.7% in FY18 (+50bps). Pension outflows were more gradual, softening the overall impact.

Source: UBS

The 8th Pay Commission’s reach is massive. The central government employs about 5.5 million people, including railways and defence, while state governments add another 8 million. Local bodies (2.5 million) and Central Public Sector Enterprises (CPSEs) (1.6 million) also follow similar pay structures. In total, nearly 18 million employees and their households feel the impact of CPC recommendations, along with 13 million pensioners.

Source: UBS

Government salaries and pensions aren’t just line items, they make up a significant chunk of overall spending. The good news? Any pay hike is not expected to materially affect India’s fiscal balance, making this a win-win for growth and consumption. Below table shows the impact of past Pay Commissions on India’s fiscal balance.

| 4th Pay | 5th Pay | 6th Pay | 7th Pay | |

|---|---|---|---|---|

| Year | 1986 | 1996 | 2006 | 2016 |

| Pay & Allowances (Rs Bn) | 13 | 76 | 108 | 684 |

| Pensions (Rs Bn) | 3 | 12 | 18 | 337 |

| Arrears | 3 | 40 | 181 | 121 |

| Fiscal Impact (Rs Bn) | 19 | 128 | 306 | 1142 |

| Fiscal Impact (% of GDP) | 0.6 | 0.8 | 0.6 | 0.7 |

Source: Kotak Institutional Equities

Pay commission–led income revisions have historically acted as a strong economic stimulus, influencing both consumption and household savings patterns. Traditional sectors such as housing and automobiles are expected to benefit meaningfully from higher disposable incomes. At the same time, evolving consumption preferences point toward increased demand for services, particularly quick-service restaurants (QSRs), along with select BFSI sub-sectors such as insurance and non-lending financial companies. Together, these trends help drive broader economic activity through stronger consumer spending.

Evidence from past pay revisions highlights this impact clearly. The RBI’s FY17 Annual Report noted that the implementation of the 7th Pay Commission had a significant influence on consumption trends. Private consumption grew by *8.1% year-on-year in FY17 and accounted for nearly two-thirds of India’s GDP growth during that period. In the absence of the 7th Pay Commission salary hikes, real GDP growth would have been lower by approximately 200 basis points, underscoring the importance of such income boosts.

Source: RBI

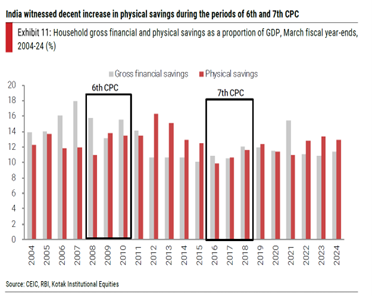

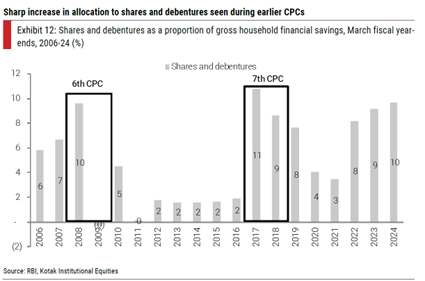

Beyond consumption, pay commissions have also had a notable, though often understated, effect on household savings. Historical trends show an improvement in physical savings following earlier pay commissions, while financial savings strengthened after the 7th Pay Commission. Additionally, there has been a visible shift toward equities within household financial savings during these phases.

With an estimated ₹2.4–3.2* trillion of additional income accruing to central government employees, incremental savings of around ₹1–1.5 trillion* are expected. These savings are likely to be distributed across physical assets, bank deposits, and market-linked instruments such as shares and debentures, providing a sustained boost to both consumption and capital markets.

Source: Kotak Institutional Equities

Source: CEIC, RBI, Kotak Institutional Equities

Who pays the bill?

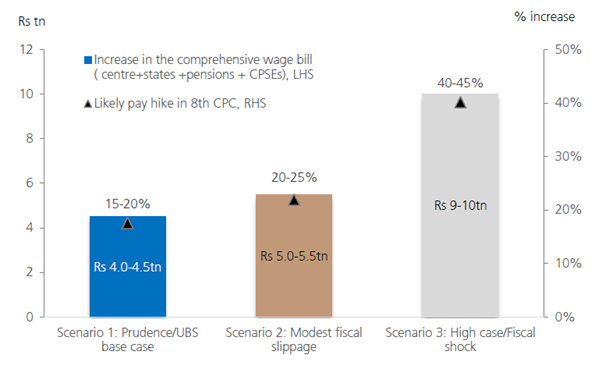

For FY25, the combined wage bill of the centre, states, and CPSEs, including pensions, is estimated at ₹25 trillion, about 7.7% of India’s GDP. Now, factor in the 8th Pay Commission: UBS’s base case suggests an additional ₹4.5 trillion, or roughly 1.1% of GDP, as the cost of the hike. That’s a big number, but one that could translate into stronger consumption and economic momentum.

Source: UBS Estimates

If implemented, the 8th Pay Commission hike will need resources, and there are a few ways to make it happen:

- Higher tax revenues

- Cuts in other spending

- A slightly wider fiscal deficit

States could shoulder nearly 60% of the total impact, turning this into a far greater challenge for their budgets. Unlike the centre, which has broader revenue streams and borrowing flexibility, states operate within tighter fiscal constraints. This disproportionate burden means they’ll need to rethink priorities, manage resources more efficiently, and possibly explore innovative financing solutions to stay afloat.

Source: UBS estimates

The 8th Pay Commission represents far more than a routine salary revision, it is a structural reset with wide economic implications. By protecting purchasing power for millions of employees and pensioners, it can meaningfully boost consumption, savings, and investment flows. While the fiscal cost is significant, especially for states, the resulting demand stimulus has the potential to support growth and strengthen India’s consumption-led economic momentum.

Archit Varshney, Senior Manager, Equity Research at Kotak AMC, adds: When 5% of India’s workforce earns more, the entire market feels it. From mortgages to meals, money circulates fast and wide. Fiscal math adjust, but growth momentum strengthens — the net outcome is broader demand and strengthening growth

The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s). These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. Companies mentioned don’t constitute recommendation, brand name affiliation disclaimer & companies mentioned for illustrative purpose only.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.