Scheme Inception date is 11/11/2003. Mr. Abhishek Bisen has been managing the fund since 15/04/2008. Different plans have different expense structure. The performance details provided herein are of regular plan. "Past performance may or may not be sustained in future. All payouts during the period h...

Read MorePortfolio

As on Feb 28, 2026

Performance

| CAGR | Value of ₹ 10,000 invested | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Since Inception | 10Y | 5Y | 3Y | 1Y | 6 M | 3 M | 1 M | 15 Days | 7 Days | Since Inception | 10Y | 5Y | 3Y | 1Y | 6 M | 3 M | 1 M | 15 Days | 7 Days | |

| Kotak Gilt - Invest Plan (G) | 8.66% | 6.92% | 4.93% | 5.75% | 2.78% | 2.26% | 1.09% | 1.16% | 0.83% | 0.57% | 95,569.20 | 19,525.40 | 12,722.98 | 11,825.79 | 10,277.71 | 10,225.73 | 10,108.53 | 10,115.68 | 10,083.36 | 10,057.47 |

| Additional -Crisil 10-year Gilt Index | - | 6.43% | 5.53% | 7.92% | 5.51% | 1.72% | 0.33% | 1.16% | 0.33% | 0.33% | - | 18,644.66 | 13,087.05 | 12,568.49 | 10,551.37 | 10,171.98 | 10,032.98 | 10,115.57 | 10,033.41 | 10,033.07 |

| Tier 1 - Nifty All Duration G-Sec Index | - | 7.36% | 6.21% | 7.73% | 4.96% | 2.32% | 0.38% | 0.79% | 0.07% | 0.00% | - | 20,339.34 | 13,517.38 | 12,503.38 | 10,495.87 | 10,232.49 | 10,038.22 | 10,078.90 | 10,006.59 | 10,000.00 |

Scheme Inception date is 29/12/1998. Mr. Abhishek Bisen has been managing the fund since 15/04/2008. Different plans have different expense structure. The performance details provided herein are of Regular Plan - Growth Option.Past performance may or may not be sustained in future. All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= Read More

As on Feb 28, 2026

| 10 Year | 7 Year | 5 Year | 3 Year | 1 Year | ||

|---|---|---|---|---|---|---|

| Average | 8.33 | 8.26 | 8.38 | 8.92 | 9.21 | |

| Maximum | 12.70 | 12.50 | 16.77 | 21.70 | 31.29 | |

| Minimum | 6.11 | 5.38 | 3.61 | 1.90 | -6.86 | |

| % times +ve returns | 100 | 100 | 100 | 100 | 95.13 | |

| % times returns > | 89.62 | 80.62 | 72.13 | 65.42 | 56.63 |

The returns are of Regular Growth Plan. Returns are calculated since inception with daily rolling frequency for the respective periods.

SWP Calculator

| NAV Date | NAV | Units | Cash Flow | Scheme Value |

|---|

| Tenors | CAGR | Current Value of ₹ 10,000 invested | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since Inception | 5Y | 3Y | 1Y | 6 M | Since Inception | 5Y | 3Y | 1Y | 6 M | |

| Kotak Gilt - Invest Plan (G) | 8.66% | 4.93% | 5.75% | 2.78% | 2.26% | 95,569.20 | 12,722.98 | 11,825.79 | 10,277.71 | 10,225.73 |

| Crisil 10-year Gilt Index | - | 5.53% | 7.92% | 5.51% | 1.72% | - | 13,087.05 | 12,568.49 | 10,551.37 | 10,171.98 |

| Nifty All Duration G-Sec Index | - | 6.21% | 7.73% | 4.96% | 2.32% | - | 13,517.38 | 12,503.38 | 10,495.87 | 10,232.49 |

Scheme Inception date is 29/12/1998. Mr. Abhishek Bisen has been managing the fund since 15/04/2008. Different plans have different expense structure. The performance details provided herein are of Regular Plan - Growth Option.Past performance may or may not be sustained in future. All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR(Compounded Annualised Growth Rate). N.A stands for data not available. Note: Point to Point (PTP) Returns in INR shows the value of 10,000/- investment made at inception. Source: ICRA MFI Explorer. # Name of Scheme Benchmark. ## Name of Additional Benchmark. Alpha is difference of scheme return with benchmark return.

- Income over a long investment horizon

- Investment in sovereign securities issued by the Central and/or State Government(s) and/or reverse repos in such securities

Details

- Additional -Crisil 10-year Gilt Index

- Tier 1 - Nifty All Duration G-Sec Index

Source: *ICRA MFI Explorer ## Risk rate assumed to be % (FBIL Overnight MIBOR rate as on NA) **Total Expense Ratio includes applicable B30 fee and GST.

Source: *ICRA MFI Explorer

## Risk rate assumed to be %

(FBIL Overnight MIBOR rate as on NA)

**Total Expense Ratio includes applicable B30 fee and GST.

- Income over a long investment horizon

- Investment in sovereign securities issued by the Central and/or State Government(s) and/or reverse repos in such securities

About the Kotak Gilt Fund

- Kotak Gilt Fund focuses on sovereign debt instruments such as central and state government securities, treasury bills and eligible repos. The fund maintains high safety by keeping 80% in government securities and actively manages duration to respond to interest rate changes making it suitable for investors seeking low credit risk and active duration management.

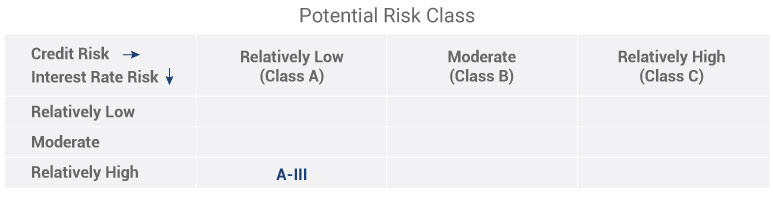

Scheme Category & Type

- Debt Scheme - Gilt Fund An open-ended debt scheme investing in government securities across maturity. A relatively high-interest rate risk and relatively low credit risk.

Investment Objective

- The objective of the Plan is to generate risk-free returns through investments in sovereign securities issued by the Central Government and/or State Government(s) and/or any security unconditionally guaranteed by the Government of India, and/or reverse repos in such securities as and when permitted by RBI. A portion of the fund may be invested in Reverse repo, Triparty repo on Government securities or treasury bills and/or other similar instruments as may be notified to meet the day-to-day liquidity requirements of the Plan. To ensure total safety of Unitholders' funds, the Plan does not invest in any other securities such as shares, debentures or bonds issued by any other entity. The Fund will seek to underwrite issuance of Government Securities if and to the extent permitted by SEBI/RBI and subject to the prevailing rules and regulations specified in this respect and may also participate in their auction from time to time.

- Subject to the maximum amount permitted from time to time, the Plan may invest in securities abroad, in the manner allowed by SEBI/RBI in conformity with the guidelines, rules and regulations in this respect. There is no assurance that the investment objective of the Plan will be achieved. It is however emphasized, that investments under the Plan are made in Government Securities, where there is no risk of default of payment in principal or interest amount.

Why Kotak Gilt Fund ?

- Invests only in sovereign securities giving you credit risk free exposure since government securities carry no default risk

- Active duration management allows the fund to benefit from changing interest rate cycles, increasing duration when rates are expected to fall and reducing it when rates may rise.

- Provides access to the government securities market which is usually dominated by institutional players enabling easy retail participation.